Getting a business loan with less paperwork is tough, but it’s doable. Online lenders and other financing options make it easier to get money fast. This means you can get approved for a business loan quickly.

No-doc business loans are made to give you quick cash with little paperwork. They have a simple application and can fund your business the next day. To find out more about getting a business loan with little paperwork, check out SVPfundinggroup.com.

Introduction to Minimal Paperwork Loans

Traditional banks take a long time to fund loans, leaving you waiting for cash. But, low-doc business loans need only the last three months of bank statements. This makes the process faster and easier, perfect for businesses needing quick funding.

Key Takeaways

- Low-doc business loans require minimal paperwork and can provide fast access to capital.

- No-doc business loans do not require any financial statements or documentation.

- Online lenders and alternative financing options offer various types of loans without collateral requirements.

- SBA loans may require a down payment ranging from 10% to as high as 30%.

- Personal guarantees and UCC liens may be required for small business loans without collateral.

- Visiting SVPfundinggroup.com can provide financing options with minimal paperwork, helping businesses learn how to get a business loan with little or no paperwork.

Understanding Modern Business Loan Requirements

Old-fashioned lenders ask for a lot of paperwork and take a long time to process applications. But, new lenders make it simpler and quicker. Now, businesses can get loans fast and with less hassle. For example, online lenders offer loans with minimal paperwork, helping small businesses get the funds they need.

The world of business loans has changed a lot lately. Modern lenders, like those at SVPfundinggroup.com, make it easier to get money. This has led to more small businesses getting loans, with a 5.68% increase in Q4 of 2023.

Traditional vs. Modern Lending Approaches

Old lenders want businesses to make $150,000 to $250,000 a year to get a loan. But, online lenders are more flexible, needing only $100,000 a year. Some even accept businesses making as little as $36,000 to $50,000. This shows how modern lenders are more open to helping businesses, even those with less income.

The Rise of Simplified Loan Processing

Now, getting a loan is faster and easier. This has made more businesses look for financing. About 52% of new businesses make it past five years. Modern lenders even offer loans to businesses with bad credit, with scores as low as 550 to 625.

Digital Documentation Solutions

Digital solutions have made applying for loans easier. Businesses can now upload documents online. This makes the application process quicker and more efficient. With digital solutions, businesses can get the funding they need to grow and succeed with less paperwork.

How To Get a Business Loan With Little or No Paperwork

Getting a business loan with little paperwork is easier than you think. It involves a streamlined business loan application and a hassle-free business financing experience. No-doc business loans are short-term or revolving credit lines. They’re great for businesses that can’t get traditional loans.

Online lenders and alternative financing companies offer these loans. They provide a quick small business loan process and fast access to funds. Companies like SVPfundinggroup.com specialize in no-doc loans for startups and small businesses.

To get a no-doc business loan, you need a good personal credit score, over 700. You might also need to provide collateral. The loan’s repayment ability is key to avoid debt. Payments are based on the loan amount, interest rate, and term.

- Unsecured lines of credit

- Equipment financing

- Invoice financing

- Business credit cards

These options help businesses grow and expand without lots of paperwork. Choosing a hassle-free business financing option lets businesses focus on growing.

| Loan Option | Loan Amount | Credit Score Requirement |

|---|---|---|

| Unsecured Line of Credit | Up to $100,000 | 700+ |

| Equipment Financing | Up to $500,000 | 650+ |

| Invoice Financing | Up to $1,000,000 | 600+ |

Essential Documents You Can’t Skip

When you apply for easy business loans, having the right documents is key. This ensures a hassle-free loan process. Even with simplified business loan requirements, some documents are must-haves.

You’ll need basic business info, financial statements, and legal papers. These documents help speed up your application. Some lenders might ask for personal bank statements too, especially if you need a personal guarantee.

Here are some important documents to prepare:

- Business name and address

- Tax ID number

- Financial statements, including income statement and balance sheet

- Legal documentation, such as business license and articles of incorporation

Having these documents ready makes the application process smoother. Always check with your lender for specific needs, as they can differ.

| Document | Description |

|---|---|

| Business License | Proof of business registration and authorization to operate |

| Articles of Incorporation | Document outlining the structure and purpose of the business |

| Financial Statements | Documents showing the business’s income, expenses, and financial position |

Digital Solutions for Paperless Applications

Applying for a business loan has gotten easier with digital technology. Now, you can get loans with less paperwork thanks to online applications. At SVPfundinggroup.com, businesses can apply for loans with just a few clicks.

Digital solutions bring many benefits. They save money, make customers happier, and help the environment. By ditching paper, businesses cut down on printing and storage costs. They also get faster and more accurate results, making customers happier.

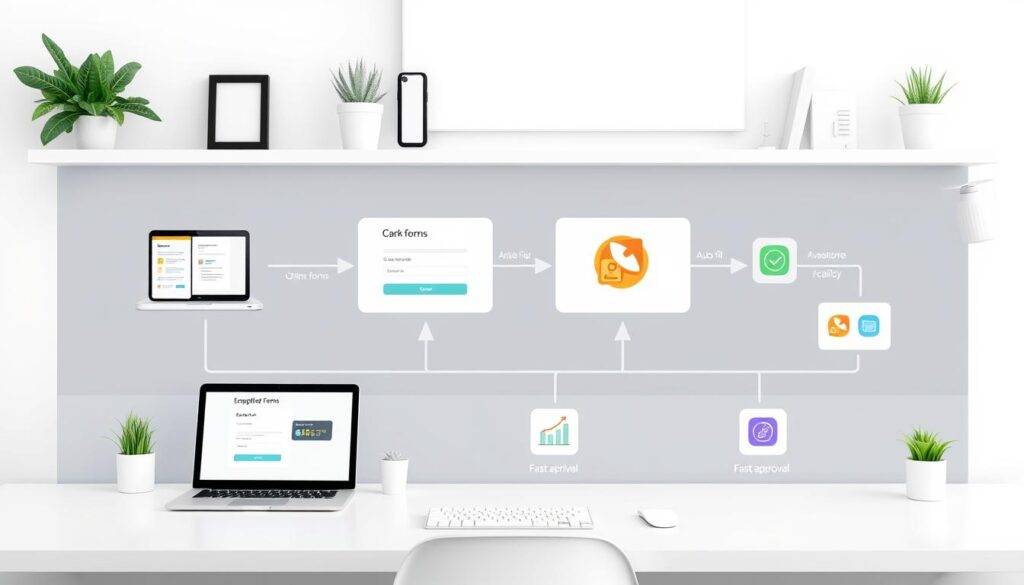

Here are some ways digital solutions make loan applications easier:

- Online loan applications and electronic signatures

- Automated credit checks and verification

- Secure and accessible digital documentation

By using digital solutions, businesses can get loans faster and with less hassle. This lets them focus on growing and succeeding.

| Benefits of Digital Solutions | Description |

|---|---|

| Reduced Costs | Eliminate expenses associated with printing, storing, and managing paper documents |

| Increased Customer Satisfaction | Faster turnaround times, fewer errors, and improved customer satisfaction |

| Positive Impact on the Environment | Reduce paper waste and minimize carbon footprint |

Quick Approval Methods for Business Funding

Now, getting an online business loan is easier than ever. You can apply online with simple requirements and get your funds fast. This change helps businesses grow and succeed.

Online lending is fast. Many lenders have online platforms for quick applications. This is great for businesses needing money fast, like those in retail or hospitality.

Streamlined Application Process

Online business loans can be approved in just 24 hours. This is much faster than traditional loans, which can take months. With online loans, you can apply, upload documents, and get a decision all in one place.

Many lenders also have mobile apps for uploading documents. This lets businesses apply from anywhere, anytime. Electronic systems check your identity and credit fast, speeding up the process.

Benefits of Quick Approval Methods

Quick approval methods offer many benefits. They give businesses fast access to capital, simple requirements, and quick funding. Online lending lets businesses focus on growing, not waiting for loans.

Alternative Lending Options with Minimal Documentation

For businesses looking for business financing options with less paperwork, alternative lending is a good choice. Options like invoice financing and merchant cash advances need minimal paperwork. They offer quick access to capital. Online lenders like OnDeck and Fundbox make it easy, with fast application processes and funds available quickly.

The small business loan application process for these options is simpler. For example, invoice financing uses unpaid invoices as collateral. Merchant cash advances look at a few months of business credit card statements. These are great for businesses that can’t get traditional loans or need money fast.

Some popular alternative lending options include:

- Invoice financing: provides around 85% to 90% of the invoice value upfront

- Merchant cash advances: require minimal paperwork and qualify based on business credit card statements

- Online lenders: offer various levels of loan amounts and minimum credit score requirements for no-doc business loans

When looking for a minimal paperwork business loan, it’s key to check the interest rates and fees. Make sure they fit your business’s financial situation. By looking into these options, businesses can find the right business financing options for their needs.

| Lender | Loan Amount | Repayment Terms |

|---|---|---|

| OnDeck | Up to $250,000 | 3-24 months |

| Fundbox | Up to $150,000 | 3-6 months |

Preparing Your Digital Business Profile

Getting no doc business loans or low documentation business loans needs a solid digital business profile. This profile is key for lenders to check your business’s trustworthiness and money health. A good online look helps lenders verify your business info, making the loan process easier.

For finance options with little paperwork, like no doc business loans, a strong digital presence is key. This means keeping your digital money records current and correct. This helps you apply for loans faster and boosts your approval chances. SVPfundinggroup.com can help you get your digital business profile ready, so you can get funded quickly.

Building a Strong Online Presence

A strong online look is crucial for businesses looking for low documentation business loans. You can do this by making a professional website, being active on social media, and getting customer reviews. A solid online presence shows your business is real and boosts its visibility to lenders.

Digital Financial Records Management

Managing your digital financial records well is also key. This means keeping your financial records accurate, detailed, and easy to find. This way, lenders can see your business’s money health and make smart loan choices.

Some important things to think about when managing your digital financial records include:

- Accurate and up-to-date financial statements

- Detailed records of income and expenses

- Current and historical bank statements

- Tax returns and other important financial documents

By focusing on your digital business profile and keeping your financial records strong, you can better your chances of getting no doc business loans or low documentation business loans. This can help you reach your business goals.

Common Mistakes to Avoid in Low-Documentation Applications

When you apply for small business loans, it’s key to avoid common mistakes. These can slow down your application and lower your approval chances. A smooth loan application process can help you get approved quickly and easily.

Some common mistakes include incomplete applications, bad credit, and wrong financial records. These errors can cause delays and lower approval rates. To avoid these, make sure your application is complete and accurate. Also, keep your credit score high.

Red Flags That May Slow Your Application

Red flags like loan stacking, too much debt, and missed chances for better loans can hurt your credit and cash flow. Taking on too much debt can cause cash flow problems, overspending, and longer repayment times. It’s wise to compare loan offers to find the best terms.

Documentation Quality Guidelines

To make your application smooth, provide top-notch documentation. This includes accurate financial records, business plans, and credit reports. By following these guidelines and avoiding common mistakes, you can boost your chances of getting small business loans. SVPfundinggroup.com can guide you through the application process and help you find the best loan options for your business.

| Loan Type | Loan Amount | Repayment Term |

|---|---|---|

| Small Business Term Loan | Up to $500,000 | 6-24 months |

| SBA-Guaranteed Loan | Up to $5.5 million | 3-10 years |

| Microloan | $500-$50,000 | 3-6 years |

Conclusion: Streamlining Your Path to Business Funding

Getting business financing can be easier than you think. Look into low documentation and fast approval loans. These options let you get the money your business needs fast and without a lot of paperwork.

At SVPfundinggroup.com, we make getting business funding simple. Our experts will help you find the right loan. Whether you need to grow, buy new equipment, or manage cash, we’re here to help. We aim to make the process smooth and get you the funds you deserve.